|

According to Kentucky’s Constitution, property owners who are 65 or older are eligible to receive a homestead exemption. If you are eligible, the amount of the exemption is subtracted from your property’s assessed value – so you will pay less property tax.

According to Kentucky statutes, the exemption amount is reviewed every two years to reflect the increase in the cost of living index used by the United States Department of Labor. For the 2015 tax year, the exemption amount is $36,900.

Example calculation: The Fair Cash Value of a property located in the city of Benton is set by the PVA at $125,000. Using 2014 tax rates as an example, the taxes due would be $1270.00 and $223.75, for the county and city respectively. However, if the property owner qualified for the Over 65 exemption, the taxable value of the property would be lowered to $88,100 (125,000-36,900) resulting in taxes due of $895.11 and $157.70.

Only one exemption is allowed per household. When an application is approved, it is valid for subsequent years as long as the original applicant owns and lives on the property. If the property is sold, the seller should contact the PVA office to notify us of the address change. The exemption will be taken off the old property and placed on the new property. In other words, the exemption is tied to the owner, not to the property. Those who currently receive the exemption need not reapply.

Application Procedure – It is easy to apply! Simply fax, mail or email the completed application, along with a copy of your valid driver’s license to the Marshall County PVA Office at the following address:

Marshall County PVA

ATTN: Exemption

1101 Main Street

Benton, KY 42025

thenson@mcpva.com

fax: 270-527-4736

You may also bring a copy of your driver’s license to the Marshall County PVA Office during normal business hours, and we will assist you with filling out the forms. We are located on the second floor of the courthouse in Benton and are open between 8:00am and 4:30pm, Monday through Friday.

According to Kentucky’s Constitution, property owners who have been declared permanently and totally disabled for the previous twelve (12) months by any public or private retirement system may be eligible for the disability exemption. If you are eligible, the amount of the exemption is subtracted from your property’s assessed value – so you will pay less property tax.

According to Kentucky statutes, the exemption amount is reviewed every two years to reflect the increase in the cost of living index used by the United States Department of Labor. For the 2015 tax year, the exemption amount is $36,900.

Example calculation: The Fair Cash Value of a property located in the city of Benton is set by the PVA at $125,000. Using 2014 tax rates as an example, the taxes due would be $1270.00 and $223.75, for the county and city respectively. However, if the property owner qualified for the Disability exemption, the taxable value of the property would be lowered to $88,100 (125,000-36,900) resulting in taxes due of $895.11 and $157.70.

To qualify as a "disabled" taxpayer, the individual must meet ALL of the following four requirements:

- Taxpayer must both own and occupy the property as his/her permanent residence.

- The taxpayer must have been classified as totally disabled under a program authorized or administered by the Federal Government or by any other retirement system- it does not matter if the retirement system is located in Kentucky or outside the state- on January 1st of the year in which the application is made and maintain the disability classification through December 31st.

- The taxpayer must be receiving disability payments pursuant to that disability classification.

- An annual application for the disability exemption must be filed with the PVA office EVERY YEAR.

Only one exemption is allowed per household. When an application is approved, it is valid for subsequent years as long as the original applicant owns and lives on the property. If the property is sold, the seller should contact the PVA office to notify us of the address change. The exemption will be taken off the old property and placed on the new property. In other words, the exemption is tied to the owner, not to the property.

Please remember in order to continue to receive the Disability Exemption you are required to submit an affidavit every year by February 15th verifying that you still maintain the classification of 100% disabled. You should receive the affidavit from our office by mid-January.

Application Procedure – It is easy to apply! Simply mail the following:

- Completed application

- Copy of driver’s license or voter registration form

- ORIGINAL documentation verifying your disability (BPQY Form from Social Security, Notice of Award Letter, etc.)

- PLEASE NOTE – Social Security sends out annual statements regarding your annual payment amounts, these will NOT count as valid documentation.

to the following address

Marshall County PVA

ATTN: Exemption

1101 Main Street

Benton, KY 42025

thenson@mcpva.com

fax: 270-527-4736

You may also bring a copy of your driver’s license and supporting documentation to the Marshall County PVA Office during normal business hours, and we will assist you with filling out the forms. We are located on the second floor of the courthouse in Benton and are open between 8:00am and 4:30pm, Monday through Friday.

|

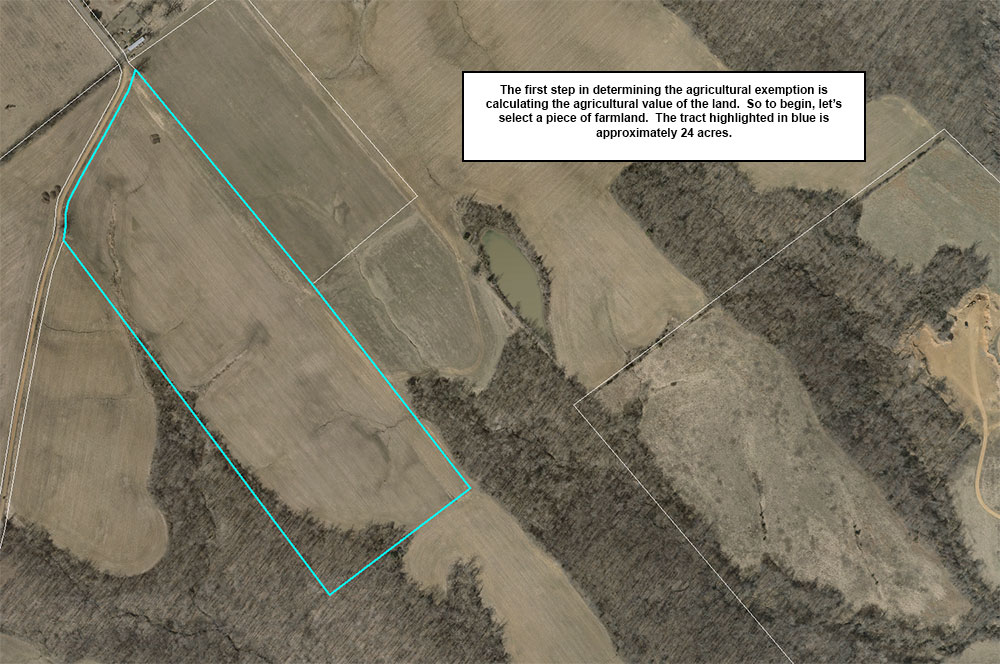

The Marshall County PVA follows the Department of Revenue's recommended agricultural assessment guidelines. These guidelines are published on a quadrennial cycle and are meant to create equitable and uniform agricultural assessments across the state.

Section 172 of the Kentucky Constitution provides for a standard of assessment of all property not specifically exempted at its "Fair Cash Value". Section 172A provides for a standard of assessment in the same manner for the properties "Agricultural Value". The Supreme Court of Kentucky in its 1984 Dolan v. Land decision ruled that the assessment of property, whether at Fair Cash Value or Agricultural Value, must result in an equal tax burden for all. It is the Office of Property Valuation's position that compliance with this court decision is obtained by having the assessment based upon land class with a separate valuation of all buildings based on the individual characteristics of the structures.

In some instances, however, information may be available that could be more useful in assessing property, which may necessitate a departure from these guidelines. Whatever method is used must result in a uniform standard of assessment.

|

|

|

|

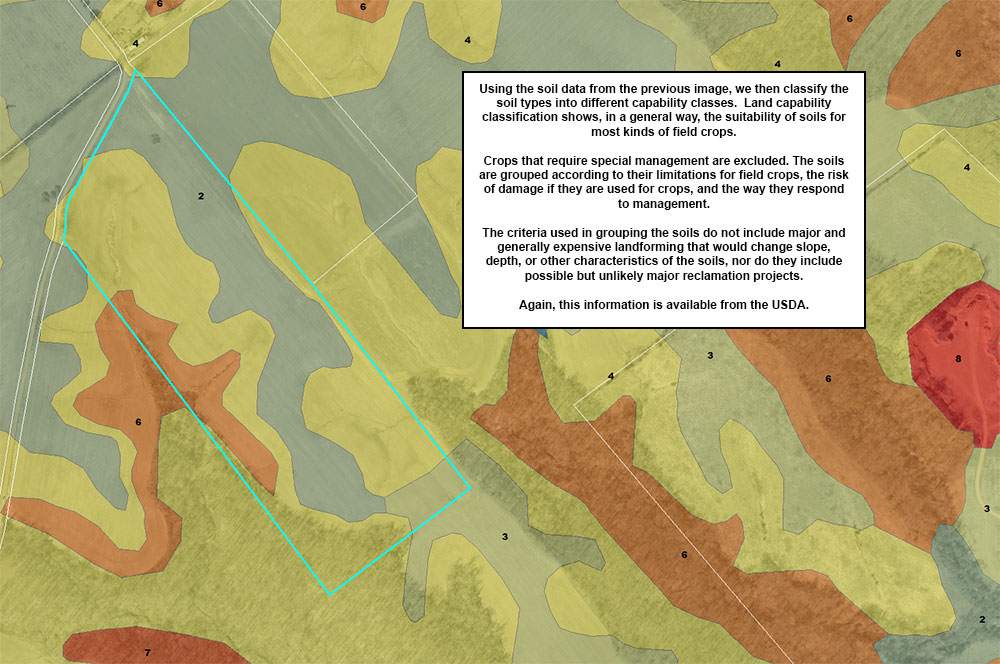

Class I |

These soils are suited to a wide variety of plants and may be used safely for cultivated crops, pasture, range, woodland, and wildlife. The soils are nearly level and erosion hazard (wind and water) is low. These soils are deep, generally well-drained, and easily worked. They hold water well and are either fairly well supplied with plant nutriments or highly responsive to inputs of fertilizer. Row crops and small grains can be grown on these soils year after year after year under high level management. This class represents level land. |

Class II |

These soils require careful soil management, including conservation practices, to prevent deterioration or to improve air and water relations when cultivated. The limitations are few and the practices are easy to apply. The soils may be used for cultivated crops, pasture, range, woodland, or wildlife food and cover. Various combinations of cropping systems and conservation practices may be used. Most recommendations include a rotation of 2 years of row crops followed by 1 year of hay and pasture. This class represents land having a slope of up to 6%. |

Class III |

These soils have more restrictions than those in Class II and when used for cultivated crops the conservation practices are usually more difficult to apply and maintain. They may be used for cultivated crops, pasture, woodland, range, or wildlife food and cover. Again various combinations of cropping and conservation practices may be used. These range from 2 years of row crops and 1 year of hay and pasture and 1 year of row crops followed by 2 years of hay or pasture. A recommended rotation consists of 2 years of row crops followed by 2 years of hay and pasture. This class represents land having a slope up to 14%. |

Class IV |

The restrictions in use for soils in this class are greater than those in Class III and the choice of plants is more limited. When cultivated, more careful management is required and conservation practices are more difficult to apply and maintain. These soils may be used for crops, pasture, woodland, range, or wildlife food and cover. This class has some severe limitations that restrict the choice of plants and require very careful management. A recommended rotation consists of 1 year of row crops followed by 3 years of hay and pasture. This class represents land having a slope up to 20%. |

Class V |

These soils have limitations that restrict the kind of plants that can be grown and that prevent normal tillage of cultivated crops. They are nearly level but some are wet, frequently overflowed by streams, are stony, and have climatic limitations, or have some combination of these limitations. This class has few erosion problems but is subject to frequent and severe flooding. This class should be kept in hay and pasture continuously. |

Class VI |

Physical conditions of soils placed in this class are such that it is practical to apply range and pasture improvements, if needed, such as seeding, liming, fertilizing, and water control with contour furrows, drainage ditches, diversions, or water spreaders. This class has severe limitations that make it generally unsuitable for cultivation. Land in this class should be limited to pasture, woodland, or wildlife food and cover. No row crops can be grown on this class. This class represents land having a slope up to 40%. |

Class VII |

Physical conditions of soils in this class are such that it is impractical to apply such pasture or range improvements as seeding, liming, fertilizing, and water control with contour furrows, ditches, diversions, or water spreaders. This class is unsuitable for cultivation and should be used only for pasture, woodland, or wildlife food and cover. A ground cover adequate for erosion control is necessary. This class represents land having a slope of up to 80%. |

Class VIII |

Soils and land forms in this class cannot be expected to return significant on-benefits from management of crops, grasses, or trees, although benefits from wildlife use, watershed protection, or recreation may be possible. This class has severe limitations that prevent use for commercial production of plants and restricts the use to recreation, wildlife, water supply or esthetic purposes. |

|

|

|

|

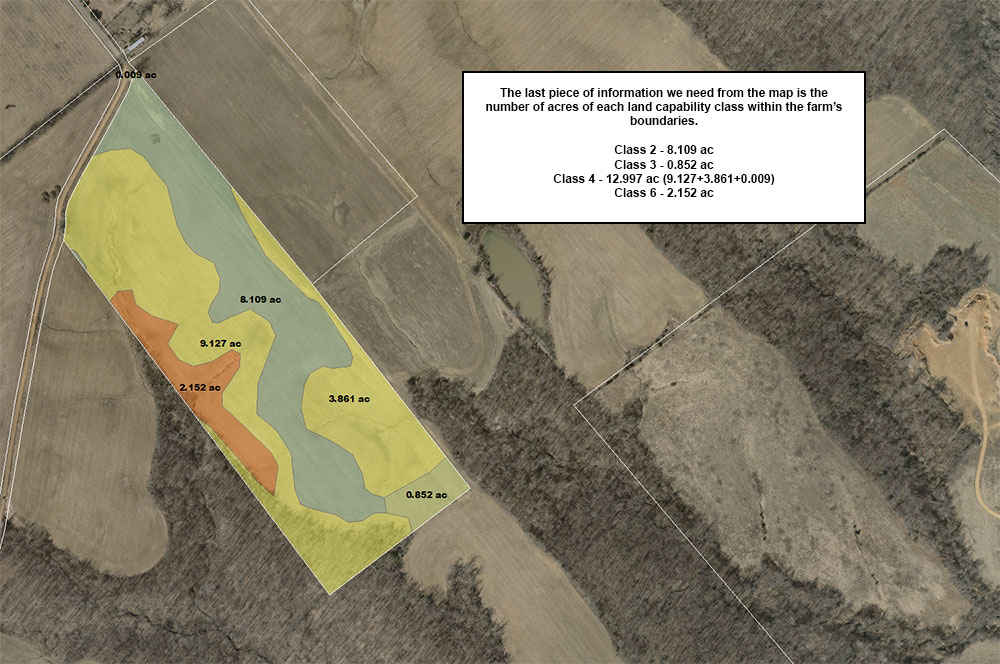

Our mapping work completed, it's time to calculate the agricultural value. There are many valid methods of determining value, but "cash rent" has been selected by the Department of Revenue as the basis for development of agricultural values for assessment purposes. Cash Rent was chosen because it is reflective of income producing capability and is derived from the market.

The use of cash rent as an indication of agricultural use value has several advantages. First, it represents an income stream to the landowner. The owner has accepted an agreeable (and market driven) rent in the form of a cash payment rather than assume the risk and costs involved in personally pursuing the production of crops or livestock. Second, cash rents depict gross income from investments in land that can be used to determine the use value of that land. Rents are related to farm land values in that they reflect the economic returns to the land, which yield estimates of value when capitalized.

Below you will find a simiplified version of the 5 step process the Department of Revenue uses to develop the per acre figure for each land capability class:

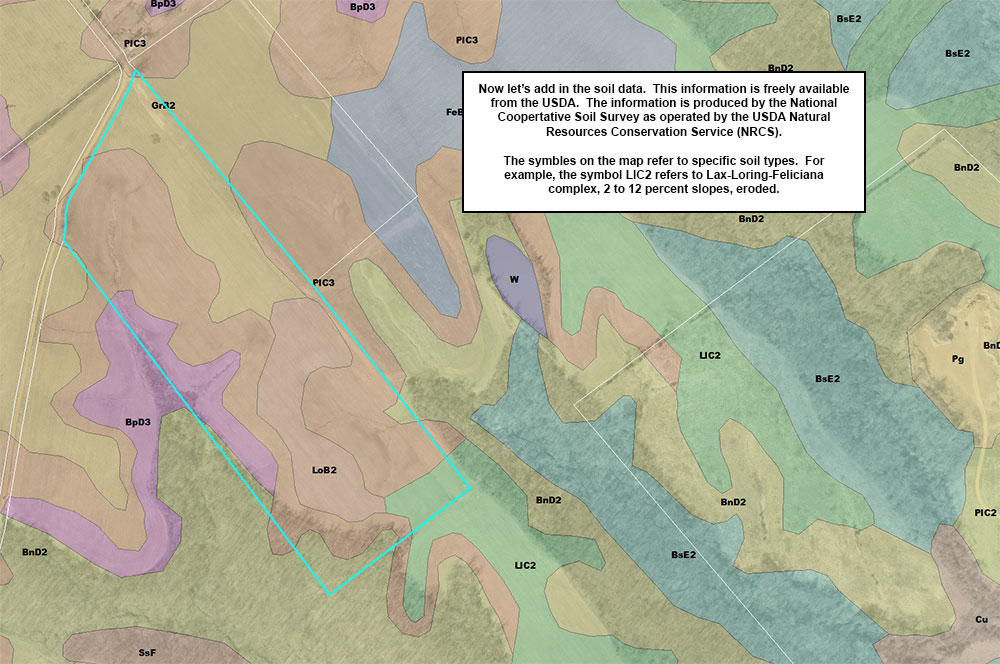

- Land Capability Classification

- Refer to the images and descriptions above

- Cash Rents by USDA District

- There are six agricultural statistical districts (ASDs) in Kentucky- Marshall County is in the Purchase ASD.

- The average unadjusted cash rent values for each district are calculated from the last ten years of averaged data collected from each county in the relevant ASD.

- Adjustment to Per Acre Rental Amount for Improvements

- A reduction is made to the average cash rent values to compensate for any farm improvement.

- Farm improvements are valued separately

- Application of Per Acre Rents to each Land Capability Class

- Having calculated the per acre rents for cropland and pastureland, we can allocate those values to the 8 land capability classes.

- Capitalization of Cash Rent

- Capitalization is the process of translating or converting an income stream into an indication of the present value of a property

- The formula for developing the capitalization rate for use in assessing farm land in Kentucky is the "mortgage-equity" method. This is composed of the actual cost of money to a farm purchaser together with the purchaser's equity investment.

|

Nonprofit organizations seeking property tax exemption pursuant to Section 170 of the Kentucky Constitution must complete the 62A023 application.

According to Section 170 of the Kentucky Constitution, real property owned and occupied by, and personal property owned by institutions of religion are exempt from taxation. Additionally, real property owned by institutions of purely public charity is exempt from taxation. Institutions of religion seeking property tax exemption for real property pursuant must complete the 62A023-R application.

The property tax exemption applies to all personal property owned by a church, including motor vehicles, office equipment, furniture, and any other personal property held in the church’s name. Real property must not only be owned, but also occupied by the church in order to qualify for the tax exemption. The following properties are considered both owned and occupied by a religious institution, and therefore tax exempt:

- Minister occupied parsonages

- Land and improvements used for church camps

- Church meeting halls or social centers used by its members

- Outdoor recreation areas held for use by church members

|